Order flow in trading is like getting a sneak peek behind the curtain of the market, letting you see how the big players are moving. Let’s dive into this, breaking it down piece by piece to make it digestible.

1. Understanding the Basics

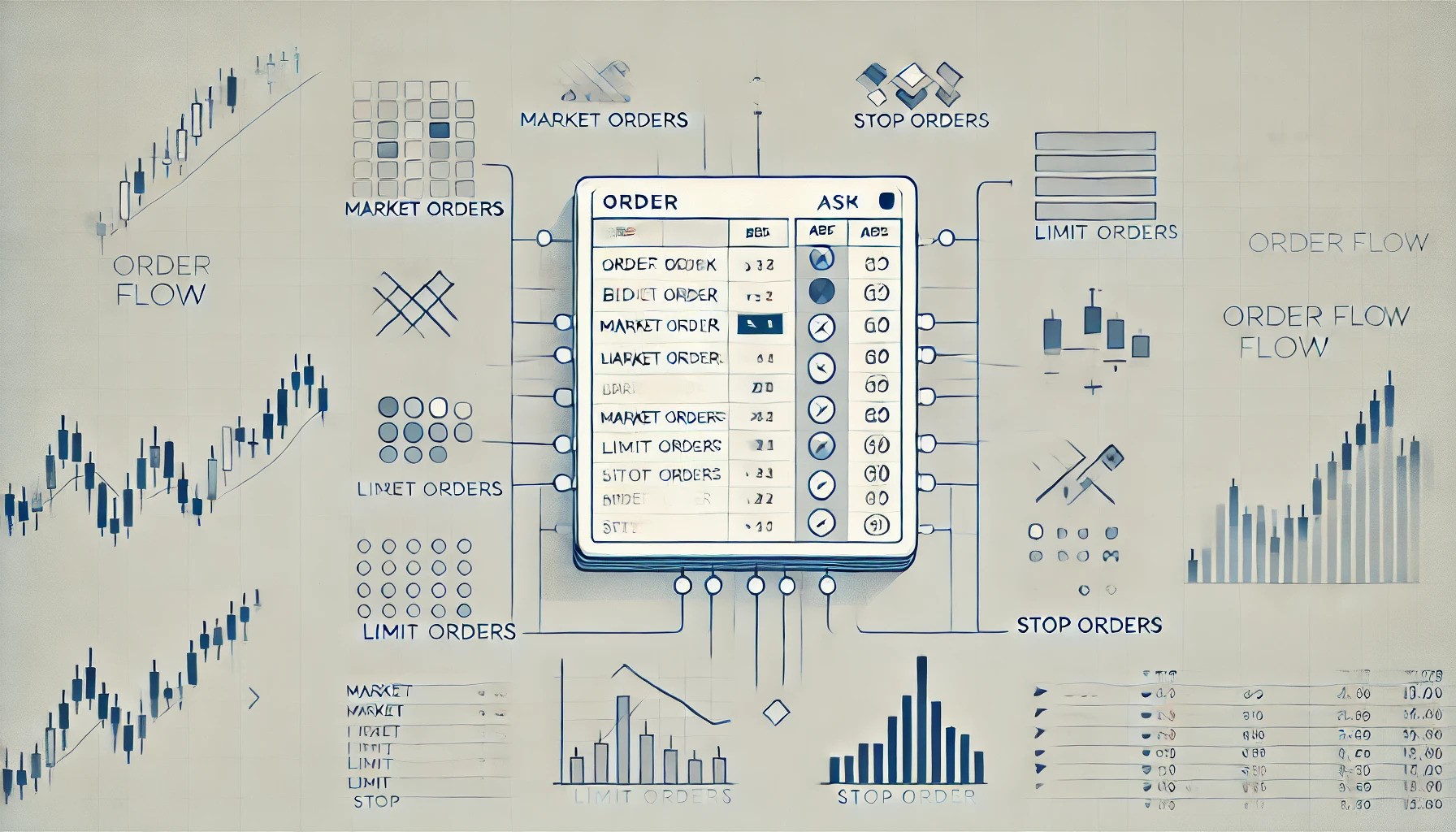

Order flow is essentially the heartbeat of the market. It’s all about understanding who is buying and selling, and how much they’re trading. This gives you a feel for the market’s supply and demand. Here’s the breakdown:

- Market Orders: These are the "I need it now" orders. They get filled immediately at the current best price.

- Limit Orders: These are the "I’ll wait for my price" orders. They only get filled if the market hits a specific price.

- Stop Orders: These are "trigger points" set to buy or sell once the price reaches a certain level.

2. Key Components of Order Flow

a. Order Book

Think of the order book as a marketplace bulletin board showing all current buy and sell interest for a stock. It’s split into:

- Bid Side: Buy orders. Example: 10 shares at $100, 20 shares at $99.

- Ask Side: Sell orders. Example: 15 shares at $101, 10 shares at $102.

This gives you an immediate snapshot of where buyers and sellers are lining up.

b. Tape Reading

This is the art of watching the ticker tape—a stream of recent trades. It tells you the price and volume of each trade. For example:

- 5 shares traded at $100

- 10 shares traded at $101

- 15 shares traded at $100

3. Putting It All Together: Analyzing Order Flow

a. Liquidity

Liquidity is about how smoothly you can buy or sell without pushing the price too much. High liquidity means lots of orders and little price movement when you trade. Low liquidity means fewer orders and more price impact.

Example:

- High Liquidity: Blue-chip stocks like Apple or Microsoft have tons of buy and sell orders at various prices, making it easy to trade large quantities without a big price change.

- Low Liquidity: A small-cap stock might have fewer orders, so buying or selling can move the price more significantly.

b. Imbalance and Momentum

Order flow helps spot imbalances—times when buying or selling pressure is skewed. If there are significantly more buy orders than sell orders at a given price, it suggests upward pressure.

Example: If the order book shows:

- 100 buy orders at $100

- 20 sell orders at $101

You might expect the price to rise as the buying pressure overwhelms the selling.

4. Using Order Flow in Trading Strategies

a. Scalping

Scalpers use order flow to make quick, small profits by exploiting short-term imbalances. They watch the order book and tape closely to enter and exit positions rapidly.

b. Day Trading

Day traders might use order flow to time their trades within the day. They look for large orders or patterns in the tape that suggest where the price is heading next.

Conclusion

Order flow is a powerful tool that offers a real-time view into the market’s inner workings. By understanding who is buying and selling, and in what quantities, you can better predict price movements and make more informed trading decisions. Whether you’re scalping for quick gains or day trading for bigger moves, mastering order flow can give you a serious edge in the market.